Accused of Healthcare Fraud?

Put a trial lawyer who wins in your corner.

188 Acquitted Counts. $550 Million saved.

The Chapman Law Firm has achieved full acquittals in complex healthcare fraud cases. Led by a former Federal prosecutor and Supreme Court Advocate.

Ron Chapman discussing the 13 count dismissal in United States v. Kumar.

Results Matter

“The members of the jury would light up whenever Ron was going to speak. His performance in the courtroom was remarkable.” Joseph Oesterling

Target Letter? OIG Subpoena or Healthcare Fraud Strike Force Probe?

DOJ/OIG/DEA actions move fast and escalate quietly—often before charges are public. Early moves can narrow subpoenas, protect privilege, and shut down bad assumptions about medical necessity, billing, and kickbacks.

Trial Results, Not Just Talk

Your constitutional right is to have a dedicated advocate on your side to fight for you - not to push you into a plea agreement. Our lawyers fight, and win!

Advanced Data Analytics

Our success stems from our healthcare and data experts and our knowledge of healthcare regulations. Our lawyers and investigators have advanced healthcare degrees.

Appeals and SCOTUS Experience

We’ve been victorious at all levels of federal court, including SCOTUS. We know appeals, and we use that to make your trial more effective while preserving important appeals issues. ’

Former Federal Prosecutor and DOJ Experience

With lawyers who have prior government experience and investigators with prior DOJ experience, we know how the DOJ fights.

National Reputation as the Best

A federal judge declared Ron Chapman the best trial lawyer he’s seen in his 20 years on the bench. Ron is nationally renowned and fights hard for his clients.

Success is our priority

Each defense must be geared towards minimizing the impact of your healthcare fraud charges. We tailor a defense strategy towards your goals.

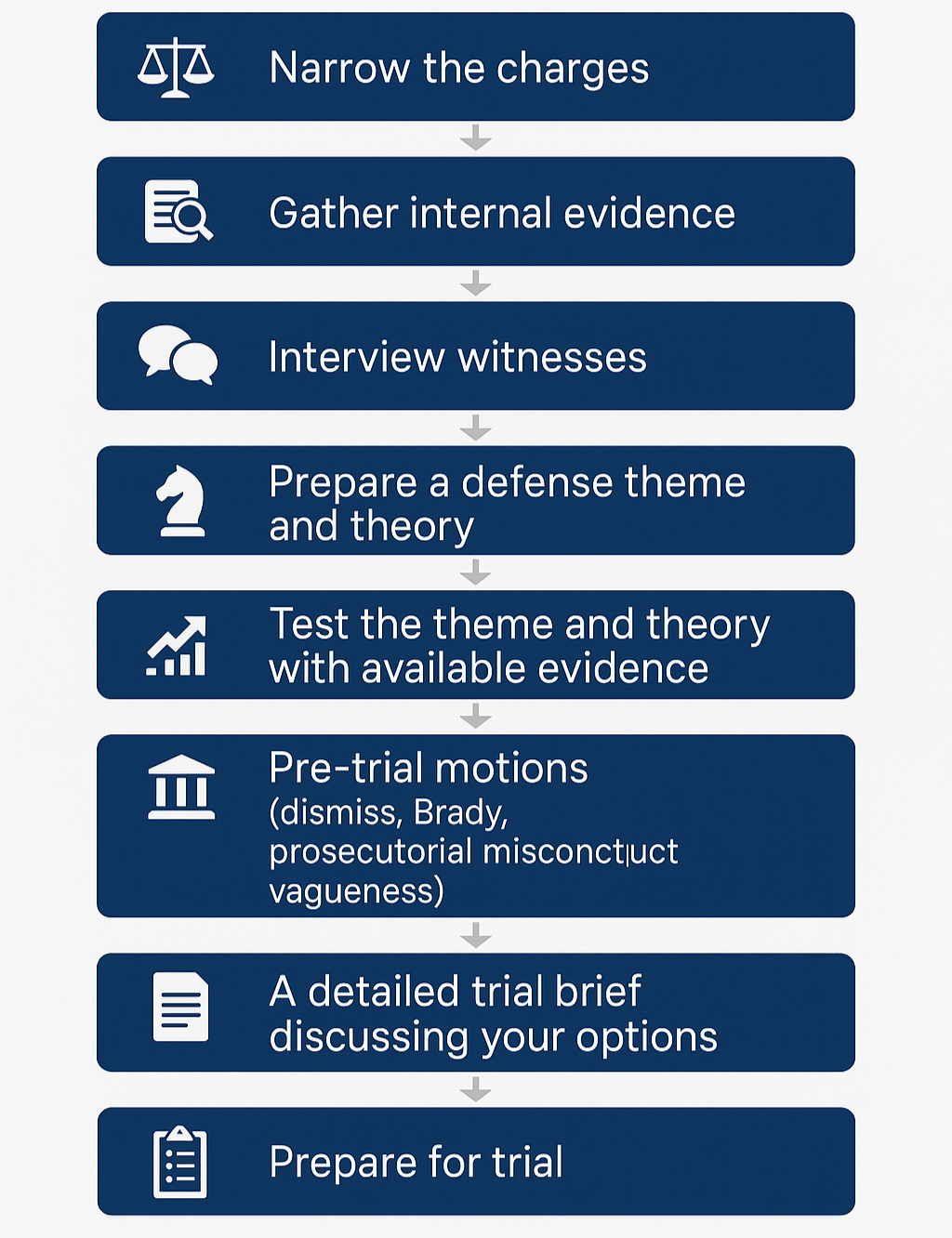

HEALTHCARE FRAUD DEFENSE PROCESS

Proven strategies that lead to success in healthcare fraud cases.

Recent Results

-

Ronald W. Chapman II secured a complete acquittal for Dr. Loey Kousa, who faced charges of healthcare fraud, drug trafficking, and maintaining a drug-involved premises. This triumph is particularly noteworthy as Chapman defeated the Department of Justice's Healthcare Fraud Strike Force, showcasing his exceptional legal acumen and dedication to justice.

-

Ronald W. Chapman II successfully secured a complete acquittal for Dr. Kendall Hansen, who faced severe allegations from the Department of Justice, including healthcare fraud and drug trafficking. This victory against the DOJ Strike Force underscores Chapman's formidable legal expertise and his unwavering commitment to defending his clients' rights and reputations.

-

Ron surprised the DOJ by winning a complete not guilty verdict in United States v. Bothra, a complicated healthcare fraud case.

-

Two federal opioid death charges were dropped in United States v. Sachy. He walked free after trial.

-

Full acquittal in United States v. Pompy a Detroit drug indictment against an interventional anesthesiologist.

Read More

-

Full acquittal in People v. Joseph Oesterling, a Mayo Clinic-trained physician charged with drug trafficking.

-

United States v. McCutchen, a Detroit physician was charged in a wide ranging Oxycodone drug conspiracy.

-

In United States v. Aggarwal Ron secured a full acquittal of a physician accused of drug trafficking and healthcare fraud.

Frequently Asked Questions

-

When a grand jury target letter, OIG subpoena, CID, or DOJ healthcare fraud investigation lands, speed matters. Ronald W. Chapman II immediately narrows subpoena scope, protects privileged records, and negotiates production timelines. We conduct a parallel internal review (billing, CPT/HCPCS coding, medical necessity support, referral arrangements) to identify defenses early and avoid charges.

If agents executed a search warrant at your clinic, pharmacy, lab, or telemedicine operation, we move to challenge overbroad seizure, secure a return of critical business property, and pursue an early proffer only when it helps—not because the government demands it.

-

Ron is President of the Safe Harbor Group.

The Safe Harbor Group team of professionals includes former government investigators who have worked for Medicaid Fraud Control Units, major insurance companies, and state boards of medicine.

This gives our clients an edge when facing healthcare fraud investigations, as our team has firsthand knowledge of how these investigations are conducted and what the government is looking for in terms of evidence.

-

In False Claims Act (FCA) and qui tam cases, the government must prove materiality and scienter (intent). We attack those elements: many disputes are honest billing/coding disagreements or ambiguous LCD/NCD rules—not fraud. For Anti-Kickback Statute (AKS) and Stark Law theories, we build safe-harbor and exception defenses (fair market value, commercial reasonableness, group practice, personal services, space/equipment leases).

We also address alleged remuneration (consulting, speaker fees, marketing, ownership interests) with compliance documentation and expert valuation. On damages, we challenge multipliers and push for dismissal or favorable resolution before trial.

-

RAC, UPIC/ZPIC, TPE, and commercial payer audits can spiral into criminal exposure if mishandled. Chapman’s approach: fix the audit record first. We rebut extrapolation with statistical experts, shore up medical necessity and documentation, and pursue ALJ appeals while negotiating to lift payment suspensions. If auditors refer your case to law enforcement, your audit file becomes your first line of criminal defense—so we make it strong and consistent.

We also contest CMS overpayment demands, coding edits, and alleged unbundling/incident-to issues, and align your compliance narrative across agencies.

-

If charges are filed—healthcare fraud, wire fraud, conspiracy, AKS—we try the case like it matters, because it does. We attack intent and materiality, exclude unreliable sampling and expert testimony (Daubert), and use defense experts (coding, FMV, compliance) to show your decisions were reasonable. Jury instructions and Rule 29/33 motions are built in from day one to preserve appellate issues.

If there’s a conviction, we fight loss calculations, argue for variances under 18 U.S.C. § 3553(a), and pursue appeals focused on evidentiary error, jury instruction defects, or prosecutorial overreach. Chapman’s track record of federal wins reflects meticulous prep and relentless advocacy.

Get Help Today

Talk to an Attorney Immediately or Schedule a Free Consultation

All consultations are confidential

How Healthcare Fraud is Prosecuted

Healthcare fraud statutes used by the DOJ

Healthcare Fraud

18 U.S.C. § 1347

This statute makes it a federal crime to knowingly and willfully execute, or attempt to execute, a scheme to defraud any healthcare benefit program or to obtain, by means of false or fraudulent pretenses, any money or property owned by, or under the custody of, any healthcare benefit program. The penalties for violating this statute include a fine, imprisonment up to 10 years, or both. If the violation results in serious bodily injury, the imprisonment can be up to 20 years, and if the violation results in death, the violator can be sentenced to life imprisonment.

False Statements Relating to Healthcare Matters

18 U.S.C. § 1035

This statute makes it a federal crime to knowingly and willfully falsify, conceal, or cover up by any trick, scheme, or device a material fact, or make any materially false, fictitious, or fraudulent statement in connection with the delivery of or payment for healthcare benefits, items, or services. The penalty for violating this statute includes a fine, imprisonment up to 5 years, or both.

Theft or Embezzlement in Connection with Healthcare

18 U.S.C. § 669

This statute makes it a crime to embezzle, steal, or otherwise, without authority, knowingly convert to the use of any person other than the rightful owner, or intentionally misapply any of the moneys, funds, securities, premiums, credits, property, or other assets of a healthcare benefit program. The penalties for violating this statute include a fine, imprisonment for up to 10 years, or both.

Anti-Kickback Statute

42 U.S.C. § 1320a-7b(b)

This federal law prohibits the exchange (or offer to exchange) of anything of value in an effort to induce (or reward) the referral of federal healthcare program business. Violations of the Anti-Kickback Statute can result in imprisonment up to 5 years, a fine up to $25,000, or both. Violators can also be subject to three times the amount of damages sustained by the government.

False Claims Act

31 U.S.C. §§ 3729

This statute allows for penalties of $5,500 to $11,000 per false claim, and triple the amount of the government's damages.

Finding a Health Care Fraud Attorney

Ronald W. Chapman II offers not just hope but tangible results. With a storied history of acquittals and favorable outcomes, Chapman's defense strategies are tailored, tenacious, and tested. His victories span across a spectrum of healthcare fraud cases, affirming his position as a preeminent defense attorney in this complex field.

Results That Speak Volumes

Acquittals in Federal Charges: From Kentucky interventional pain physicians to renowned rheumatologists, Chapman has secured acquittals against daunting federal charges, showcasing his ability to navigate the intricacies of healthcare law successfully.

Dismissal of Charges: Cases involving serious allegations, including opioid trial charges and accusations of drug trafficking, have been dismissed under his defense, reflecting a deep understanding of both legal and medical nuances.

Successful Defense in High-Stake Cases: Chapman's strategic defense has led to the recapture of over $450 million for his clients in 129 recent counts of acquittal.

Your Defense Strategy

Choosing Ronald W. Chapman II means opting for a defense grounded in thorough investigation, personalized strategy, and an unwavering commitment to your rights and future. Understanding the gravity of healthcare fraud charges, Chapman employs his extensive knowledge and strategic acumen to navigate each case towards the best possible outcome, ensuring that your side of the story is heard, respected, and effectively represented.

Health Care Fraud Investigation Process

The fight against Medicare fraud is a top concern for the Justice Department, leading to the mobilization of various agencies, including the notable Medicare Fraud Strike Force. The Strike Force operates in Detroit, Houston, Miami, and other areas. In these areas, charges for health care fraud are much more common.

Click to read about recent health care fraud prosecution statistics

Unfortunately, this rigorous scrutiny often ensnares healthcare providers who may unknowingly deviate from compliance or engage in non-fraudulent activities. Experts with backgrounds in both State and Federal Medicare fraud analysis spearhead investigations, armed with the knowledge to both identify potential fraud and strategize defenses effectively.

Key Players in Medicare Fraud Investigations

The landscape of federal enforcement against Medicare fraud is vast, involving numerous entities. Investigations might kick off with a MAC audit, alerting the Office of Inspector General (OIG) upon suspicion, underscoring the critical nature of MAC audits for providers. Local US Attorney's offices, the FBI, and UPICs contracted by Medicare also play pivotal roles, with UPICs analyzing data for anomalies in billing practices that could indicate fraudulent activities.

Crucial Agencies Explained

HHS OIG: With a mission to safeguard HHS programs, including Medicare, this agency deploys audits and investigations to detect and deter fraud.

Medicare Fraud Strike Force: A collaborative team focusing on the detection, prevention, and prosecution of fraud, utilizing data analytics to pinpoint suspicious activities.

DOJ: Integral to the legal proceedings, deciding on the pursuit of civil or criminal charges based on investigations.

FBI: A key investigative body in white-collar crime related to healthcare fraud.

MACs and UPICs: Frontline entities in identifying billing irregularities and conducting initial audits and investigations.

How the DOJ Investigates Healthcare Fraud

Detection and Initial Analysis

Initiation: Investigations often start from anomalies detected during routine Medicare Administrative Contractor (MAC) audits, tips from whistleblowers, or data analysis indicating deviations from normal billing practices.

Data Analysis: Use advanced data analytics to identify unusual patterns, such as billing for services not rendered, upcoding, and other discrepancies.

Preliminary Investigation

Desk Audit/Statistical Review: Conduct a detailed examination of the provider's billing data and compare it against typical billing patterns for similar services in the industry.

Inter-agency Collaboration: Engage with Unified Program Integrity Contractors (UPICs) to further analyze data and identify potential fraud.

In-depth Investigation

Covert Investigation Phase: Without alerting the subject, gather more in-depth evidence through covert means, such as reviewing additional documents from various sources, conducting discreet interviews, and using subpoenas for obtaining records.

Overt Investigation Phase: Transition to more direct methods like issuing formal subpoenas, conducting on-site visits, and interviewing employees and patients.

Referral for Prosecution

Compilation of Evidence: Organize and review all gathered evidence to build a strong case.

Inter-agency Review: Present findings to the Department of Justice (DOJ) and work with the Federal Bureau of Investigation (FBI) and the Health and Human Services Office of Inspector General (HHS OIG) for legal analysis and determination of prosecutable offenses.

Legal Proceedings: Assist in drafting the referral to the DOJ, outlining potential charges and participating in the strategy for grand jury presentations or direct filings.

Agencies Involved:

Medicare Administrative Contractors (MACs): Initial detection and audit.

Unified Program Integrity Contractors (UPICs): Data analysis and integrity checks.

Department of Justice (DOJ): Legal review and prosecution.

Federal Bureau of Investigation (FBI): Criminal investigations.

Health and Human Services Office of Inspector General (HHS OIG): Oversight and specialized investigations.

Defending Health Care Fraud Charges

Successful Defense Requires a Career’s Worth of Knowledge and a Sophisticated Defense

Defending charges of healthcare fraud, requires a sophisticated defense by defense council who are prepared and experienced in defending healthcare fraud charges.

Unfortunately, most attorneys who do not regularly practice in the healthcare fraud arena do not understand the complexities of medical billing requirements, Medicare rules and regulations such as LCDs and NCD. Many attorneys also don’t understand the complex decisions in Supreme Court and district court cases related to healthcare fraud.

Read: Example Case Study Acquittal in a $450 Million Health Care Fraud Case

Without such an investigation, a defendant has no chance of a trial victory, or of securing a deal that they are satisfied with. Many attorneys lack the resources the knowledge and the desire to aggressively attack the government’s theory in order to improve a healthcare, fraud, defendants case posture.

While each and every defense of a case is unique, many healthcare, fraud, allegations have been repeated time and time again by the government. The government typically recycles, similar theories and similar cases. Having significant experience defending healthcare fraud charges across the country Ron has become familiar with these theories and can spot them coming a mile away. This helps a provider posture, their defense around that theory to achieve victory.

For a more detailed guide on each aspect of the process please click the links below:

Grand Jury Target Letter: Notification of being under investigation. Counsel begins protective measures and strategizes defense.

Grand Jury Investigation: Evidence is reviewed by a grand jury to decide on charges. Defense counsel may start negotiations or prepare for a potential indictment.

Defense Investigation: Counsel conducts a thorough investigation to counter government claims, gathering evidence and expert testimonies.

Indictment: Formal charges are filed if probable cause is found. Counsel reviews charges to develop defense strategies.

Arraignment: Defendant is formally charged and enters a plea. Counsel ensures the defendant understands their rights and the charges.

Detention Hearing: Determines if the defendant will be detained or released until trial. Counsel argues for the least restrictive conditions.

Discovery: Prosecution shares evidence with defense. Counsel scrutinizes evidence for weaknesses and formulates defense.

Pre-Trial Motions: Counsel may file motions to dismiss charges or suppress evidence, aiming to weaken the prosecution's case.

Trial: Evidence is presented before a judge or jury. Defense counsel challenges the prosecution's case, aiming for acquittal.

Ron has tried more healthcare fraud cases to an acquittal than any other attorney in recent history. He is skilled at each stage of this process and expertly navigates his clients through healthcare fraud allegations to protect their rights.

Health Care Fraud Sentences

The Federal Sentencing Guidelines for health care fraud in the United States are part of the broader Federal Sentencing Guidelines, which are designed to provide a framework for sentencing individuals convicted of federal crimes, including health care fraud. Health care fraud can encompass a wide range of activities, such as billing for services not rendered, billing for more expensive services than those actually provided, or performing unnecessary services for the purpose of billing. The specific guidelines for health care fraud are detailed in the Guidelines Manual.

Calculation of Sentences Using the Guidelines

The calculation of sentences under the Federal Sentencing Guidelines involves a two-step process:

Determination of the Base Offense Level: The base offense level for health care fraud is determined by the amount of loss caused by the fraudulent activity. The Guidelines specify increasing offense levels based on the monetary value of the loss, with higher amounts of loss resulting in higher base offense levels.

Adjustments: After determining the base offense level, adjustments are made based on specific characteristics of the offense or the offender. These can include upward adjustments for factors such as the involvement of sophisticated means, the defendant’s role in the offense, or whether the fraud endangered the welfare of individuals. Downward adjustments may apply if the defendant accepts responsibility for the offense.

Specific Guidelines and Enhancements

Loss Amounts: The Guidelines use the amount of loss to the victims as a primary determinant of the offense level. The Guidelines table specifies offense levels for loss amounts, starting from less than $6,500 to more than $550,000,000, with corresponding offense levels ranging from level 6 to level 38.

Sophisticated Means: If the fraud involved sophisticated means, such as elaborate schemes to hide the fraudulent activity, an increase in the offense level is warranted.

Role in the Offense: Defendants who organized, led, managed, or supervised the fraudulent activity may receive an increase in their offense level.

Number of Victims: If the fraud affected a large number of victims, additional points might be added to the offense level.

Typical Health Care Fraud Sentences

Sentences for health care fraud can vary widely based on the specifics of the case, including the amount of loss, the defendant’s criminal history, and other factors mentioned above. Sentences can range from probation for cases involving lower amounts of loss and no prior criminal history, to several years in prison for cases involving significant loss or harm to victims.

Probation to Short-term Imprisonment: For lower levels of loss without aggravating factors, sentences may range from probation to short-term imprisonment.

Moderate to Long-term Imprisonment: For significant loss amounts, especially those involving sophisticated schemes or a large number of victims, the guidelines recommend moderate to long-term imprisonment.

It's important to note that while the Federal Sentencing Guidelines provide a framework, judges do have discretion to impose sentences outside these guidelines under certain circumstances. This can include considerations of the defendant’s history, cooperation with authorities, the impact of the fraud on victims, and other factors.